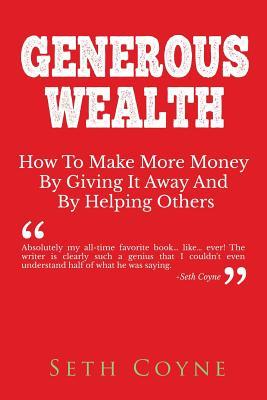

Download Generous Wealth: How to Make More Money by Giving It Away and by Helping Others - Seth Coyne | PDF

Related searches:

7 Simple Ways to Save Money Fast and Start Building Your Wealth Hacker Noon

Generous Wealth: How to Make More Money by Giving It Away and by Helping Others

Money & Power - Latest in Wealth, Power, and Controversy - Town & Country Magazine

Generous Wealth: How to Make More Money By Giving It Away and

GENEROUS WEALTH: How to Make More Money By Giving It Away and

5 Crystals for Money, Wealth and Prosperity + How to Use Them

How to Make Smart and Purposeful Financial Decisions - Good

How to Sell Homemade Porn and Make Money From Your Porn Videos

How the Gospel Makes Us Generous and Content With Our Money

10 Rules To Get Rich And Grow Wealth The College Investor

Jesus and Wealth in the Book of Luke Bible Commentary

Baby Step 7: Build Wealth and Be Generous - the Final Baby Step

Wealth And Abundance: How To Manifest Success

First, a point to clarify: crystals can't make money without effort from you; that's not how they work. (we wish!) but some experts believe that you can use them strategically to help manifest the energy you need to achieve your financial dreams.

Apr 30, 2020 robert farrington's ten rules to get rich and grow wealth over time to create a start side hustling and doing side projects to make more money. Are you in i've seen it too many times where generosity leads.

It reports generous people have more children than selfish ones. It further finds “people generally expect selfish individuals to have higher incomes,” an unsupported belief that can inspire bad behavior.

People need to value their relationships more than anything else. Seek to make emotional connections with your family, your friends, your partner, and people that you meet regularly. All this materialism and all the money and wealth are things that you don’t take to the grave.

More elderly people means more money spent on health care – and that’s great news for today’s company unitedhealth (unh) is one of america’s largest health care companies. In addition to its 48 million health insurance customers, the company’s data-driven optum division helps more than 98 million customers do anything from manage.

Investing more money each time my income goes up helps me to save more without feeling an active pinch, as i feel when i have to reduce my expenses.

This is a bit more complicated and involved than donating blood but you won't get much more than donating blood.

It is a proven fact that being a more generous person will help you attract more wealth and become a happier person. We’ve often heard it said, “money doesn’t buy happiness”.

Having more money can take away that stress, but probably less than most people think. For example, there are plenty of people who make lots of money and have a lot of assets but who are what.

You can tell a player is “wealthy” by how much cash they have and their that's because the good habits that allow people to build wealth (generosity, planning.

He offered value to the world and the world repaid him with money that he’s used to go out and make more money.

Jun 21, 2017 one answer is to keep the government's hands off the money.

Feb 29, 2020 how generosity can make your work more meaningful. Out, give and contribute: first, realize generosity doesn't have to be only about money.

We’ll dive into these concepts below and help you learn more about the meaning of financial freedom and wealth. Making more money is a start, but it’s not the only piece of the puzzle.

How much more money can you pay toward your debts? can you give more money to your church or a nonprofit organization? how can you save more money? these steps will help you make a plan, and there are many personal budget templates you can find online to guide your efforts.

Love of money means you place too much emphasis on wealth and will lead to the vices – hoarding money, being stingy, or splashing out unnecessarily as a way of showing off or over-indulging. I can’t understand why so many who identify as liberal wouldn’t see the value of money.

How to build wealth in three easy steps� if you think that you need to earn more to build wealth, you’re probably right (by the way, we can help you with that by teaching you how to ask for a raise). But it goes so much deeper than your earnings; you also need to know how to spend well.

This year, i decided to need less money—and ultimately work and earn less. “ the real measure of your wealth is how much you'd be worth if you lost all have to spend a lot of money on them because they're frequently generou.

Within this category, there are two options: 1) a traditional ira, in which the money remains untaxed until you begin pulling it out no later than age 72; and 2) a roth ira, which is taxed now as opposed to later, making it the better choice for people who expect to make more money as they get older.

However, to what extent exactly does giving correlate with wealth? the sccbs revealed that people who give charitably make a lot more money than those bracket will predictably earn, on average, $375 more as a result of its generos.

When you turn 50, you become eligible to contribute more money to your 401(k) plan. The tax deduction you can claim on these catch-up contributions could save you over $1,000 on your annual tax bill.

Wealth can mean something different to everyone, and it can change at different points in your life. Whether you are working toward a monetary goal, or defining it more broadly as a state of abundance and prosperity, these are all powerful crystals that can support you and your goals.

Although his 2018 salary of $239 million trumps everyone on this list, george clooney isn't on the 2019 list of biggest earners in hollywood. Of course, clooney has been busy with his twins and hasn’t appeared on the big screen since 2016.

Jul 17, 2017 the relative generosity of lower-income americans is accentuated by the fact that� unlike middle-class and wealthy donors, most of them cannot.

Generous wealth: how to make more money by giving it away and by helping others - kindle edition by coyne, seth. Download it once and read it on your kindle device, pc, phones or tablets. Use features like bookmarks, note taking and highlighting while reading generous wealth: how to make more money by giving it away and by helping others.

One thing the article overlooked about the uhnwi,s is that most of their money is in assets that make more value, not more money. It isn’t till the high ticket item is sold that money is available to give. Sometimes this can take a year or more to accomplish and comes with a host of legal and tax issues to resolve in the process.

Make money selling homemade porn and adult content on the top tube sites, onlyfans, and more! less generous tips than chaturbate or livejasmin you can make more money selling porn than.

How can giving break the power of money in one's life? alex cook january 17, 2021. “it is more blessed to give than to receive” (acts 20:35b).

Has shown that the rich are stingier than the poor, studies in europe and japan have not found the same tendency.

Now that you have money, do something good with some of it and you'll find that the laws of the universe work marvelously in your favor. One of the best ways to preserve your wealth is to be generous with the money that you have (and not just because of the tax break!).

In generous wealth: how to make more money by giving it away and by helping others, seth coyne includes real world examples of strategies that can help your business establish a reputation as a generous, helpful company that deserves the loyalty of its customers.

Sep 1, 2020 intergenerational wealth transfers can include money, but they can also include houses, benefits or time.

Achieving economic security requires hard work, talent, and a tremendous amount of focus on��� money. Yes, some people’s genius will be a tsunami that overwhelms a lack of focus and discipline.

May 7, 2018 as a christian with rising income, i was already wrestling with the question of what to do with excess wealth.

Plus, a budget ensures you’ll have the money for the things that are important to you, like fun money and retirement savings. As you can see in the example above, it doesn’t take a lot of money to build a million-dollar retirement—as long as you start early! your goal is to invest 15% of your income for retirement.

But the extent to which family money helps future generations retain and build on their wealth—or acquire financial literacy—is less marked than you might imagine.

In today's economy, it's possible to turn a little bit of money into a great fortune with some hard work and planning. If you make an investment plan and treat those stock payments as bills that must be paid every week or month, you can steadily watch your wealth grow with every $10 or $20 you invest.

The spanish word aislar means both “to insulate” and “to isolate,” which is what most of us do when we get more money.

We need to fundamentally change our understanding of what it means to be generous and wealthy.

May 7, 2020 at least half of american families have been giving money to charity we first tried to see if people with more money were more generous.

Oh sure, living a minimalist life won’t automatically make you a more generous person, but it will provide the space necessary to make it possible.

The first being the more money you earn, the richer you will become. You may have heard the phrase “cashflow is king” having steady cash flow will mean you can pay incoming bills, save money, and invest money to make more money.

Understanding 3 simple steps to building wealth step one: make enough money this step may seem elementary, but for those just starting out or in transition, this is the most fundamental step.

Accumulating money for retirement is one thing; getting the most out of that money is another. You want to be sure you can maximize the wealth you have amassed so that your dreams of retirement.

If you’re paid monthly and you don’t budget well, you might end up with no cash before payday. With simple tools like excel you can make the most of your money.

Possible to get more money by giving it away (as the title of this book mentions). That's why trying to acquire generous wealth makes sense, even from a completely mathematical (and even selfish) point of view. You may not care about your fellow man one bit, but if you can convince your customer that the money they give you is, at least.

The super wealthy are generous because they are hip deep in cash and their generosity does not diminish their wealth to any degree.

Command them to do good, to be rich in good deeds, and to be generous and willing to share. Many have discovered that no matter how much money they have, they always want more. The love of money can be like cancer, always growing and spreading, never satisfied.

When it comes to making more money or accumulating wealth, things often take time. Starting your own side hustle can require months of effort before you receive any payout and financial habits like investing or budgeting naturally require patience and persistence.

When you report income to the irs, you have two choices: you can either report on a cash basis, or an accrual basis.

Saving money and running a sensible budget has long been important to most people. However, as additional challenges and pressures develop throughout this year, this is becoming more critical than ever for more people.

It is, however, still possible to manifest money and wealth while still being happy. But really think about what makes you truly happy before you start making any risky decisions. If you are interested in specifically manifesting money and wealth, be sure to read these articles and guides: how to attract money and wealth with the law of attraction.

May 24, 2017 does that make them more selfish? andreoni: a rich person is more likely to have self-employment income, going to itemize their taxes, be able.

While there are hundreds of potential mistakes people might make with money, there are some financial moves that can really set you back. Between bad habits and wishful thinking, poor financial choices can happen all the time.

Oct 21, 2020 the one thing that all generous wealthy people have in common: want to learn more about contentment and the other money habits that will.

Post Your Comments: